What is Generative AI?

In the ever-evolving landscape of artificial intelligence, one revolutionary concept has taken centre stage: Generative AI.

This cutting-edge technology, short for Generative Artificial Intelligence (AI), possesses the remarkable ability to conjure new content across various mediums, from images and text to video, audio, simulations and even code. By harnessing the power of Generative AI, novel content can be crafted based on specific input data, such as prompts, queries or existing samples.

At the forefront of this AI-driven transformation is ChatGPT, an extraordinary chatbot equipped with generative capabilities. The ‘GPT’ in its name stands for ‘generative pre-trained transformer’, signifying its proficiency in generating responses to an impressive array of questions. This free and accessible chatbot has garnered significant attention owing to its capacity to provide answers on an extensive range of topics.

The fundamental mechanism behind Generative AI involves the utilisation of deep learning algorithms, with generative adversarial networks (GANs) being a notable example. These algorithms adeptly uncover patterns and features within the provided dataset, subsequently employing this knowledge to craft entirely new data that aligns with the underlying input information.

Remarkably, the capabilities of Generative AI extend far beyond content creation.

“Generative AI will fundamentally change the way investing & trading is done.”

Dr. Ayesha Khanna, AI Entrepreneur and Advisor

Have a listen to what AI entrepreneur and advisor Dr. Ayesha Khanna has to say about how generative AI will change trading and investing, in The Vantage View.

In the following discussion, we’ll delve deeper into the transformative potential of Generative AI within the trading and investment domain.

3 Ways Generative AI Will Change Trading and Investing

Let’s explore three extraordinary ways in which Generative AI is poised to redefine the very fabric of trading and investing.

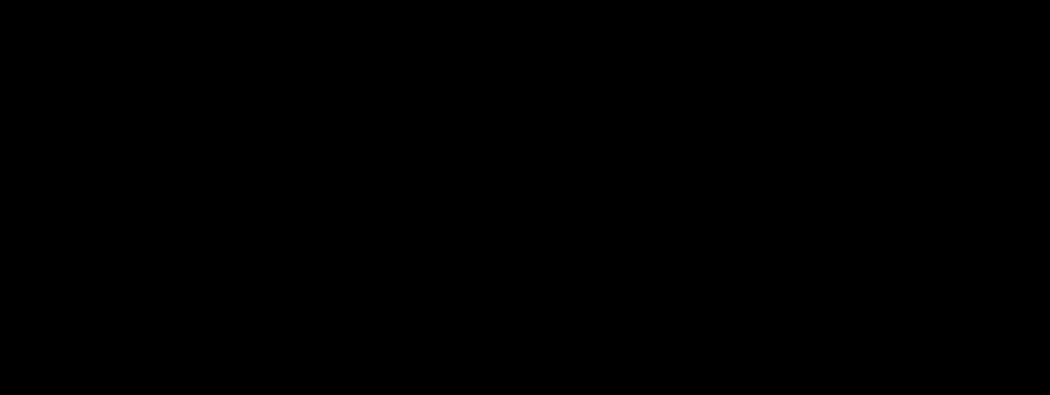

But first, let’s hear what ChatGPT has to say about how AI will change trading and investing.

1. Revolutionise the landscape of investing and trading

- Speed and efficiency: Generative AI processes vast data volumes and executes trades rapidly, enabling traders to respond to market changes with unprecedented speed. Some of the ways that Generative AI can help include enhancing market research and analysis, generating realistic scenarios and simulations for stress testing.

- Risk management: Generative AI plays a crucial role in recognising potential risks and formulating trading strategies aimed at mitigating such risks. These algorithms can be configured to consistently oversee market dynamics and pinpoint potential threats by analysing elements such as price fluctuations, market volatility, news developments and trading activity. Through the automated execution of stop-loss orders, once specific thresholds are met, traders can restrict their losses and reduce exposure to risk1.

- Data-driven insights: AI provides data-driven insights that challenge traditional investment strategies, uncovering trends, correlations and opportunities that human analysts might overlook.

An example of how generative AI can help with data-driven insights is Generative AI can generate realistic scenarios and simulations by creating synthetic data that mimics the characteristics and patterns of real-world data, such as market prices, economic indicators, customer behaviour, etc. This can help traders and investors test their strategies and assumptions under different conditions and scenarios and optimise their portfolios accordingly2.

2. Personalised AI assistant

Gone are the days when we have to rely on humans for assistance as Generative AI slowly takes over the role of acting as a personalised AI assistant by providing traders and investors with relevant information, insights and recommendations based on their queries, preferences, goals and risk profiles.

“Never before has this community really benefitted from having an AI assistant.”

Dr. Ayesha Khanna, AI Entrepreneur and Advisor

Some of the possible ways Generative AI can assist traders and investors include:

- Answering questions about markets, stocks, trends, risks and opportunities.

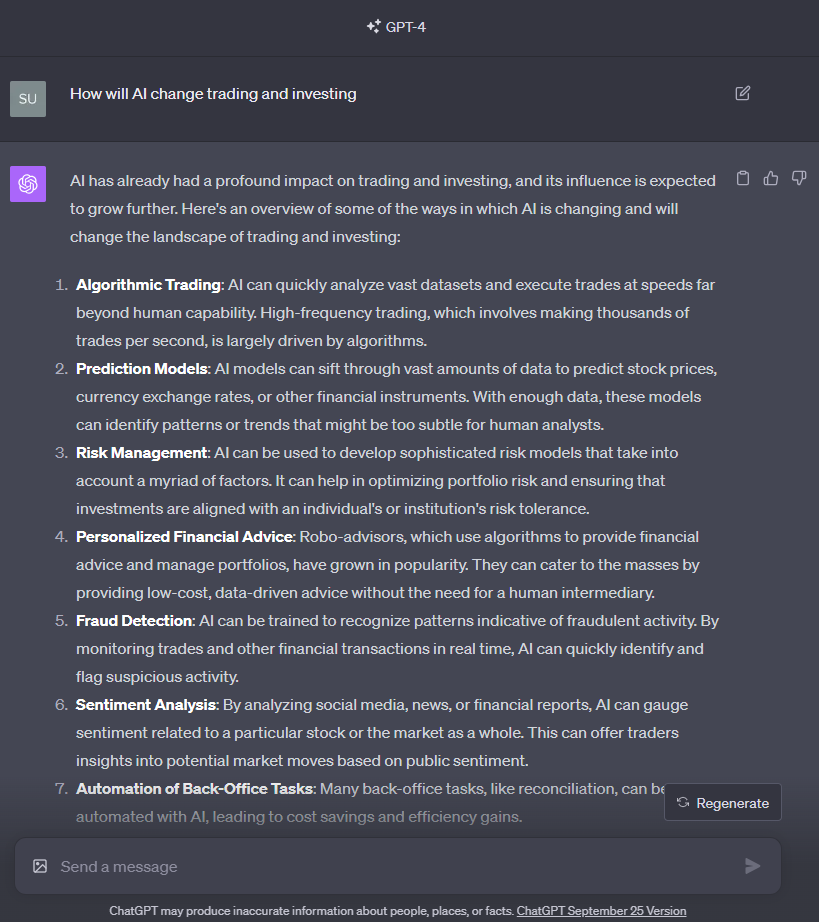

- Generating summaries, reports and analyses of large amounts of data from various sources, such as company reports, news articles and social media.

To note: Do keep in mind that certain systems, such as ChatGPT, may have access to information only up until specific dates

- Providing personalised trading advice and feedback based on the user’s preferences, goals and risk profiles.

Generative AI can enable the creation of personalised investment advice and strategies based on an individual’s financial goals, risk tolerance and investment horizon. By analysing a person’s financial situation and preferences, AI-powered systems can generate tailored investment recommendations and even automate portfolio management for retail investors.

3. Research and insights easily available

With generative AI, research is now made more accessible than ever. Here’s how generative AI makes research available to the man on the street, analyst or not:

- Big data analysis: AI can analyse vast datasets, including historical market data, earnings reports, news articles and social media sentiment, making this wealth of information accessible to analysts of all sizes.

- Customised reports: AI can generate customised research reports and summaries based on specified needs, saving analysts time and providing relevant information to inform their decisions.

- Efficiency: By automating research processes, AI allows analysts to focus on higher-level analysis and strategy development rather than spending time on data collection and processing.

- Broad coverage: AI can cover a wide range of assets and markets, from stocks and bonds to cryptocurrencies and commodities, ensuring that analysts have access to comprehensive market insights.

Conclusion

“Those who are able to do it well, will far outpace everyone else in the industry.”

Dr. Ayesha Khanna, AI Entrepreneur and Advisor

This groundbreaking technology is poised to revolutionise the way we navigate financial markets, ushering in an era of unparalleled speed, efficiency and data-driven decision-making.

But that’s not all – Generative AI is also a powerful force for inclusivity. It tears down the barriers that once separated experts from novices, democratising access to advanced tools and insights. It offers a helping hand to traders and investors of all backgrounds, equipping them with the potential to make more informed and efficient decisions.

How will you be using AI in your trading? Follow us on social media @vantagemarkets and let us know in the comments!

Reference

- “Brokers, Traders, and Generative AI: How to Improve Workflows and Decision-Making Processes – Leverate”. Brokers, Traders, and Generative AI: How to Improve Workflows and Decision-Making Processes. – Leverate. Accessed 19 September 2023.

- “From data to insights: Unlocking the power of generative AI for startups – Microsoft”. From data to insights: Unlocking the power of generative AI for startups | Microsoft for Startups Blog. Accessed 19 September 2023.

Disclaimer: The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our client. No representation or warranty is given as to the accuracy or completeness of this information and therefore it shouldn't be relied upon as such. Any research provided does not have regard to specific financial situations, needs or investment objectives. Vantage accepts no responsibility for any use that may be made of these comments and for any consequences that result. Consequently, any person acting on it does so entirely at their own risk. We advise any readers of this material to seek professional advice where necessary. Without the approval of Vantage, reproduction or redistribution of this information isn't permitted.