As the world confronts the challenges of climate change and urban congestion, the transportation industry emerges as one of the fastest-growing sources of energy-related carbon emissions. From 1990 to 2022, carbon emissions from the transportation industry increased at an annual average rate of 1.7% [1].

To align with the Net Zero Emissions (NZE) by 2050 Scenario, carbon emissions from the transportation sector must decrease by more than 3% per year through 2030 [2]. Sustainable mobility has emerged as a crucial element in the quest to achieve this. Explore the concept of sustainable mobility and five strategic ways investors can contribute to, and benefit from this growing trend.

What is Sustainable Mobility?

Sustainable mobility refers to transportation methods and systems engineered to minimise environmental impact, ensure economic feasibility, and foster social inclusiveness. Its primary objective is to reduce fuel consumption and, consequently, decrease carbon emissions. This concept extends to various practices and innovations designed to conserve energy and enhance urban living standards.

Incorporating electric vehicles (EVs), advanced public transportation networks, and other green initiatives, sustainable mobility aims to devise a framework that benefits both the environment and its residents.

The shift towards sustainable mobility represents not only an ecological and societal necessity but also a substantial economic opportunity. Cities around the globe are increasingly committed to upgrading their transportation infrastructures to align with these sustainable principles.

Copenhagen and Amsterdam are leading examples of cities transitioning towards sustainable mobility, with extensive cycling infrastructure and initiatives that encourage cycling over car usage, aligning with these sustainable principles.

How to invest in Sustainable Mobility?

“In 45% of all countries worldwide, transportation is the largest contributor to energy based emissions.”

Andrey Berdichevskiy, Partner & Associate Director,Boston Consulting Group

Investing in sustainable mobility means supporting a future where transportation is cleaner, smarter, and more inclusive. Here’s how you can invest across the value chain:

1. Electrification of Transport

The transition to electric vehicles is a cornerstone of sustainable mobility. The electric vehicles (EV) market is expected to grow exponentially, with projections indicating that in 2024, the revenue in the Electric Vehicles market will reach a staggering USD$623.3 billion worldwide, and looking ahead, it is expected to demonstrate a steady annual growth rate (CAGR 2024-2028) of 9.82% [3]. Some examples of EV companies include Tesla Inc and BYD Company Limited, among the world’s largest EV producers.

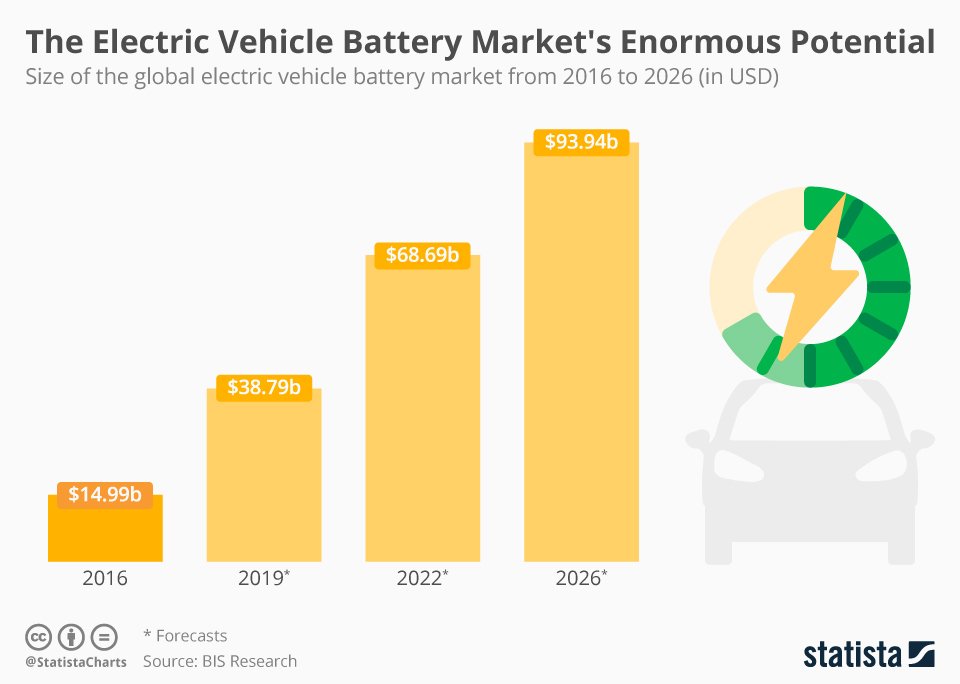

In addition to direct investment in leading EV manufacturers, there are ample opportunities available within the EV supply chain. Investors can explore investment in companies producing essential EV components, like batteries, which are fundamental to the industry’s expansion. This not only diversifies investment portfolios but also supports the broader ecosystem critical for the electric vehicle market’s growth.

Moreover, the rise of renewable energy solutions to power these vehicles further broadens the investment horizon. By investing in renewable energy firms that provide the electricity needed to charge electric vehicles, investors can contribute to a more sustainable and integrated mobility ecosystem. Some examples of renewable energy firms include General Electric Co, NextEra Energy Inc and Brookfield Renewable Partners.

This approach complements the electrification of transport by ensuring that the energy source is as green as the vehicles it powers, rounding out an investment strategy that supports sustainable mobility from production to power supply.

2. Infrastructure for Sustainable Mobility

Infrastructure development also plays a crucial role in the widespread adoption of sustainable mobility. The Global Infrastructure Outlook reports that over $2 trillion is required each year in transport infrastructure investment until 2040 to support economic development and meet the changing needs of sustainable transportation [4].

This encompasses enhancing and upgrading roads, bridges, and public transit systems, along with establishing EV charging points and deploying smart city innovations to improve traffic management and minimise emissions.

Investments in sustainable transport infrastructure offer financial potential while playing a key role in reducing the environmental impact of transportation. For example, Shenzhen, China, has become the first city worldwide to electrify its entire bus fleet, resulting in a 48% reduction in carbon dioxide emissions and significant pollutant decrease, offering cheaper annual operation costs at $98,000 for each electric buses compared to $112,000 for each diesel buses [5].

These investments improve the accessibility and efficiency of transport systems broadly and make a meaningful contribution to the development of a globally sustainable and equitable mobility landscape.

3. Raw Material Sourcing for Sustainable Mobility

Sustainable mobility is also intertwined with the ethical and environmentally conscious sourcing of raw materials such as lithium, cobalt, and nickel, which are essential for manufacturing electric vehicle (EV) batteries. The push for sustainability in this sector emphasises the importance of supporting companies that engage in responsible mining practices.

This approach not only reduces the ecological impact of material extraction but also ensures a cleaner supply chain for EVs, aligning with the broader goals of reducing carbon footprints and promoting eco-friendly transportation solutions.

Investing in companies focused on material efficiency and recycling helps reduce reliance on scarce resources and minimise environmental impact. These companies support the development of a circular economy, align with sustainability goals, and contribute to resource conservation.

Specifically, funding businesses that manage the lifecycle of EV batteries and components decreases the demand for raw materials and reduces waste, fostering innovation and environmental stewardship in the electric vehicle sector.

4. Policy and Research

Supporting policy initiatives and investing in research focused on sustainable mobility are crucial forms of investment. These efforts might encompass funding studies on emerging transport technologies, or investing in green bonds aimed at financing sustainable infrastructure projects. Such financial commitments not only fuel the sector’s growth but also resonate with broader environmental and social objectives.

For instance, the California Air Resources Board’s adoption of the Advanced Clean Cars II rule charts a year-by-year course aiming for all new cars and light trucks sold in California to be zero-emission vehicles by 2035, including plug-in hybrid electric vehicles [6]. This exemplifies a pioneering policy that propels California towards a future where the market for zero-emission cars, pickup trucks, and SUVs expands rapidly, promising cleaner air and significant reductions in climate-warming emissions.

Investing in research also plays a pivotal role in advancing sustainable mobility, which includes technological innovation and the creation of regulatory frameworks that advocate for cleaner transportation options. By channelling funds into initiatives and companies at the forefront of new technologies, such as enhanced battery technology, alternative fuels, and advanced materials, investors significantly expedite the shift towards sustainable transport solutions.

5. Sustainable Urban Planning

Sustainable urban planning extends beyond traditional infrastructure, embracing the integration of green spaces, pedestrian-friendly zones, and diverse transportation options to create more liveable and inclusive urban environments.

These initiatives are pivotal in ensuring cities meet the needs of their residents, fostering healthier and more connected communities. By prioritising investments in these areas, urban areas can significantly enhance sustainability and quality of life.

The emphasis on encouraging walking, biking, and public transit use over car dependency is a key aspect of sustainable urban design. The creation of bike lanes, green spaces, and efficient public transit networks is instrumental in this shift, offering both environmental benefits and making cities more attractive to inhabitants and businesses. This approach not only supports ecological goals but also promotes a more sustainable and enjoyable urban experience.

Moreover, the adoption of smart city technologies, particularly those powered by artificial intelligence (AI), marks a significant advancement in sustainable urban ecosystems. AI plays a crucial role in optimising traffic management systems and supporting infrastructure for electric vehicles, leading to more efficient cities with improved transportation networks.

For example, Singapore’s implementation of AI for traffic congestion management and energy efficiency in buildings exemplifies the transformative potential of AI in urban planning. By leveraging AI to analyse traffic patterns and building data, Singapore has achieved remarkable improvements in reduced travel time by up to 25%, air quality enhancement, and energy consumption reduction, setting a benchmark for sustainable urban development globally [7].

Dive deeper into the transformative future of AI with Vantage View created in collaboration with Bloomberg Media Studios and explore how AI is making transformative change.

Conclusion

As the world moves towards a more sustainable future, the opportunities for investing in sustainable mobility will continue to expand. By focusing on electric vehicles, infrastructure, innovation, critical materials, and urban planning, investors can play an active role in the shift to the environmental, economic, and social pillars of sustainability.

It encourages a balance between innovation and social responsibility while offering a pathway to support the transition towards a more sustainable mobility ecosystem.

References

- “Transport – IEA50”. https://www.iea.org/energy-system/transport. Accessed 7 Feb 2024.

- “At COP28, UNECE and partners highlight need to decarbonize inland transport and how UN tools and legal instruments can help – UNECE”. https://unece.org/media/press/386256. Accessed 7 Feb 2024.

- “Electric Vehicles – Worldwide – Statista”. https://www.statista.com/outlook/mmo/electric-vehicles/worldwide. Accessed 7 Feb 2024.

- “Built to last: Making sustainability a priority in transport infrastructure – McKinsey & Company”. https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/built-to-last-making-sustainability-a-priority-in-transport-infrastructure. Accessed 8 Feb 2024.

- “How Shenzhen turned all its 16,000 buses fully electric – Wired”. https://www.wired.co.uk/article/shenzhen-electric-buses-public-transport. Accessed 13 Feb 2024.

- “California moves to accelerate to 100% new zero-emission vehicle sales by 2035 – California Air Resources Board”. https://ww2.arb.ca.gov/news/california-moves-accelerate-100-new-zero-emission-vehicle-sales-2035. Accessed 8 Feb 2024.

- “AI in Urban Planning: Revolutionising Efficiency, Sustainability, and Quality of Life – LinkedIn”. https://www.linkedin.com/pulse/ai-urban-planning-revolutionising-efficiency-quality-life-khalilian. Accessed 8 Feb 2024.

Disclaimer: The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our client. No representation or warranty is given as to the accuracy or completeness of this information and therefore it shouldn't be relied upon as such. Any research provided does not have regard to specific financial situations, needs or investment objectives. Vantage accepts no responsibility for any use that may be made of these comments and for any consequences that result. Consequently, any person acting on it does so entirely at their own risk. We advise any readers of this material to seek professional advice where necessary. Without the approval of Vantage, reproduction or redistribution of this information isn't permitted.