Artificial intelligence (AI) has taken the world by storm. From planning your overseas itineraries, to crafting creative taglines for your marketing campaigns, and providing in-depth research for your next venture; AI seemingly can do it all.

The financial world is no different. We are now seeing the use of Artificial Intelligence (AI) in trading. As AI continues to improve, traders now have new tools and methods to help them every day in trading.

In this article, we will dive into how AI is slowly changing the trading landscape and how it can be used.

How AI is Helping to Change the Trading Landscape

AI has, without a doubt, transformed the trading landscape and trading experience of both beginners and seasoned traders alike.

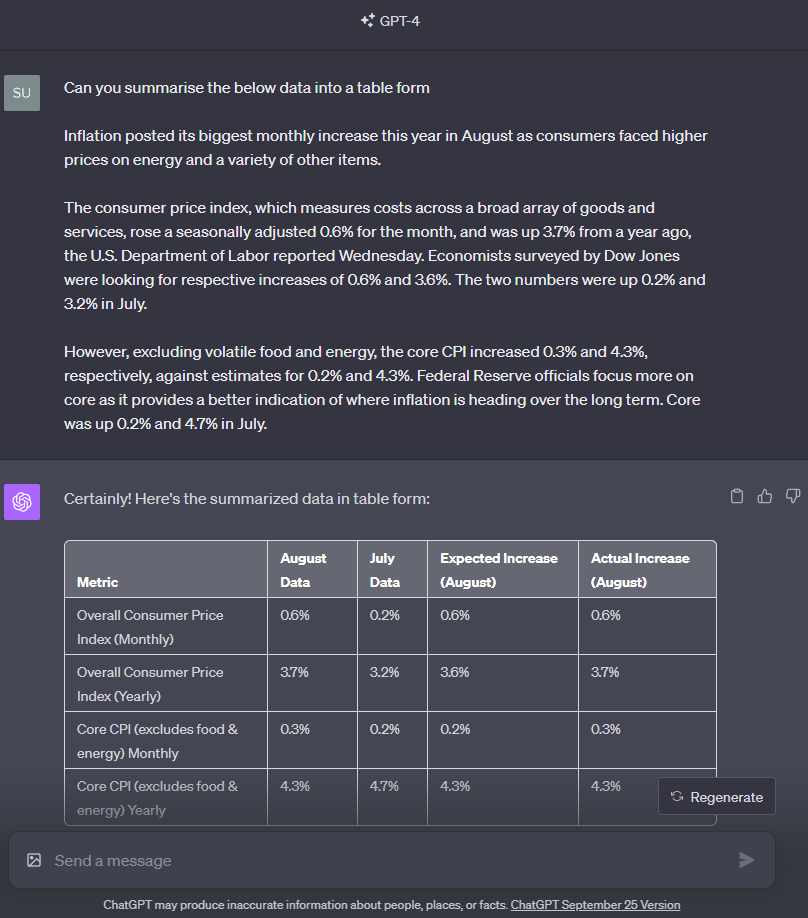

Firstly, AI can be used to plough through tons of data and provide a summary for traders. A previously time-consuming task can now be done near-instantly with the help of AI it.

Just take a look at this example:

In addition, predictive analytics, where AI models are able to forecast market movements based on past historical data, are changing trading for good. This forecasting can help to give traders a better idea of how markets have moved in the past, and how to better navigate future scenarios.

With the help of AI, trades can also be automated based on rules or scenarios, allowing trades to be executed at optimal times and minimising human errors.

How can AI be Used for Trading?

Here are four ways traders can utilise AI in your daily trades:

Machine Learning and Predictive Analytics

- Machine learning, a subset of AI, has greatly made an impact in the world of trading and beyond. At its core, machine learning is the process of training algorithms to learn from and make decisions based on data, rather than following strictly programmed instructions. This dynamic learning capability allows machine learning to adapt and improve over time as it encounters new data.

- The AI, through predictive analytics, is able to analyse and scan through a huge number of datasets in a shorter period of time compared to a normal person. Its ability to offer quicker summaries compared to manual analysis helps traders save time and making better-informed decisions.

- Typically, an average person would require some time to identify regular patterns based on historical data and trading chart patterns. This could even take years of experience. But with machine learning, this process can be simplified and it can also be used to forecast market movements through algorithms.

- As more and more data become available, the role of machine learning in predictive analytics in trading becomes increasingly important. Traditional data analysis might miss subtle patterns or get overwhelmed by the sheer data volume.

- In contrast, ML thrives in these situations, continuously refining its models for better accuracy. By harnessing historical market data, current economic indicators, and even sentiment analysis of social media, machine learning algorithms can identify the patterns that surpass human processing capacity.

Algorithmic Trading

- Algorithmic Trading involves the use of complex algorithms to place trade orders at speeds and frequencies that are often impossible for humans. This ability will help traders to capitalise the small price discrepancy over multiple trades in a short duration.

- AI trading bots and algorithms can swiftly scan numerous charts to identify favourable conditions. Once these conditions are detected, they can place and execute substantial trading orders within seconds. What sets these AI-driven systems apart from traditional algorithmic trading is their adaptability. They can learn from market behaviours and continuously refine their strategies, ensuring effectiveness even as market conditions evolve.

- Additionally, by utilising AI for trading, traders can reduce the emotional aspect when making trading decisions. Employing automated trading systems may also lead to decreased monitoring requirements due to the absence of human intervention. However, this can be a double-edged sword as AI sometimes has the potential to make poor trading decisions and would also not have insights on your trading objectives or current financial situation.

- For example, in 2012, a computer glitch in Knight Capital Group’s trading algorithm led to a loss of over $440 million, causing its stock to plummet 75% in just two days1.

Chatbots as a personal assistant

- Chatbots like ChatGPT, can assist traders in their trading endeavours. Traders can inquire about a specific stock’s performance, analyse trends from stock charts, and access historical stock data using straightforward text commands (also known as prompts). These chatbots can be trained with real-time data, and with their machine learning techniques, can improve to provide traders with more accurate responses.

- Building on this capability, chatbots can be set up to provide 24/7 news updates by connecting the chatbots to trusted news sources APIs and using fast data systems. Through this, the chatbots will be equipped with the ability to fetch and process the news data in real-time or near-real-time.

- This will allow traders to quickly get updated with the latest financial news, market changes, and big world events. With these quick updates, traders can utilise their understanding of the market conditions to better anticipate the ups and downs of the markets, adjust their trading strategy and stay ahead of the game.

Natural language processing

- Natural Language Processing (NLP) is a technology that is used to help AI to grasp and understand the human language. It enables AI systems, like chatbots, to respond effectively to user prompts which ensure smoother and more intuitive communication between machines and humans. In trading, this can be used to help traders interpret useful information from the data provided.

- NLP is able to quickly read news, financial reports and social media to provide traders with a sense of the market sentiment and trends. Also, NLP can help automate trading. Traders can train their AI systems on what to do in simple words, and with NLP, the system understands and acts on it. This allows trading to be more automated and traders will require less time to monitor their trading position.

- Moreover, NLP’s adaptability and learning capabilities are continuously evolving. As the technology advances, it becomes even more attuned to the small details of language and specific terms used in the trading sector. This fine-tuning means that traders can get more precise and relevant insights over time.

Risks of using AI in trading

Now that we have understood how AI can be used for trading, it is important for traders to understand some of the risks that come when using AI in trading.

Firstly, traders need to realise that AI is largely data dependent. The AI is trained over a set of data to be able to provide traders with a response or analysis. This also means that the AI is as good as the data they are provided or trained on. If the data provided is inaccurate, the AI system will inevitably be affected. Moreover, if the data set isn’t updated according to market changes, the AI might create trading strategies that don’t match the current market, leading to subpar trading results.

Another risk associated with AI in trading is over-reliance. Traders might start to rely too heavily on AI predictions without relying on their own analysis or intuition, which may lead to a lack of trading judgement. AI models, despite their abilities, may not be able to account for sudden market changes that occur due to unforeseen global events.

Lastly, just like other computer programs, AI can sometimes have bugs or glitches. These issues might come from small coding mistakes or how the AI works with other software. Even a tiny error can cause the AI to provide wrong answers or make bad decisions. This might lead traders to potential losses due to the AI decision.

Conclusions

Having a better understanding of the importance of AI and risks when it comes to AI in trading is important for traders. To fully capitalise on the potential of AI in trading requires a balance between both manual trading and automated trading. While AI offers a multitude of tools to streamline and optimise trading processes, with today’s technology, it has not reached the point where it can entirely replace the human touch.

Looking for a platform to use AI and start trading? Open a live account with Vantage today and start trading Contracts for Difference (CFDs). Traders can access trading opportunities on price movements in all directions, without having to own the underlying asset.

Reference

- 1. “Knight Capital Says Trading Glitch Cost It $440 Million – The New York Times”. https://archive.nytimes.com/dealbook.nytimes.com/2012/08/02/knight-capital-says-trading-mishap-cost-it-440-million/. Accessed 11 Sept 2023.